Double-entry bookkeeping is a system of accounting for business owners where every transaction is recorded in two different types of accounts:

- Debit to one account

- Credit to another account

The balance sheet of debit and credit accounts should remain the same in the double-entry system.

This article will cover the following:

- What is the double-entry accounting method?

- The Accounting equation

- Who uses a double-entry accounting system?

- How to do double-entry bookkeeping?

- Rules of the double-entry bookkeeping process

- Importance of double-entry bookkeeping

What Is The Double-Entry Accounting Method?

The double-entry method of bookkeeping means that financial transactions are saved in two different accounts. A debit is made in one account, and a credit is made in another account.

For example, a business owner buys new furniture for the business for $1000. The business owner credits the technology expense account $1000 and debits the cash account $1000. This is because the technology expense assets are worth $1000 more, and the business owner has $1000 less in cash.

Debit entries increase the assets/expense accounts and decrease the liability. Whereas credit entries always decrease the assets/expense accounts and, in return, increase liability or the equity accounts.

The Accounting Equation

Both sides of the equation should be the same for accurate accounting results. The accounting equation is given below:

Assets = Liabilities + Equity

Who Uses Double-Entry Accounting System?

As per law, all public companies should use the double-entry bookkeeping method for the proper accounting process. Public companies follow the rules devised by Financial Accounting Standard Board (FASB).

Small businesses are also recommended to use the double-entry bookkeeping method. It plays a significant role in providing accurate results and keeps the information in proper order.

How To Do Double-Entry Bookkeeping?

Double-entry accounting is mainly preferred in accounting books as compared to single-entry accounting. It is usually done by accounting software. The software helps you maintain all the records easily. It also generates monthly and yearly reports that help you with tax returns. Moreover, a business owner can also hire an accountant for this particular job.

Double Entry in Accounting

In accounting, there are three major elements of double entry:

- Each business transaction should be recorded in two accounts.

- For each transaction, the debited amount should be the same as the credited amount.

- The total assets should always equalize the liabilities and equity of a business. Both sides of the equation need to be the same.

Rules of Double-Entry Bookkeeping Process

Below are the rules for debits:

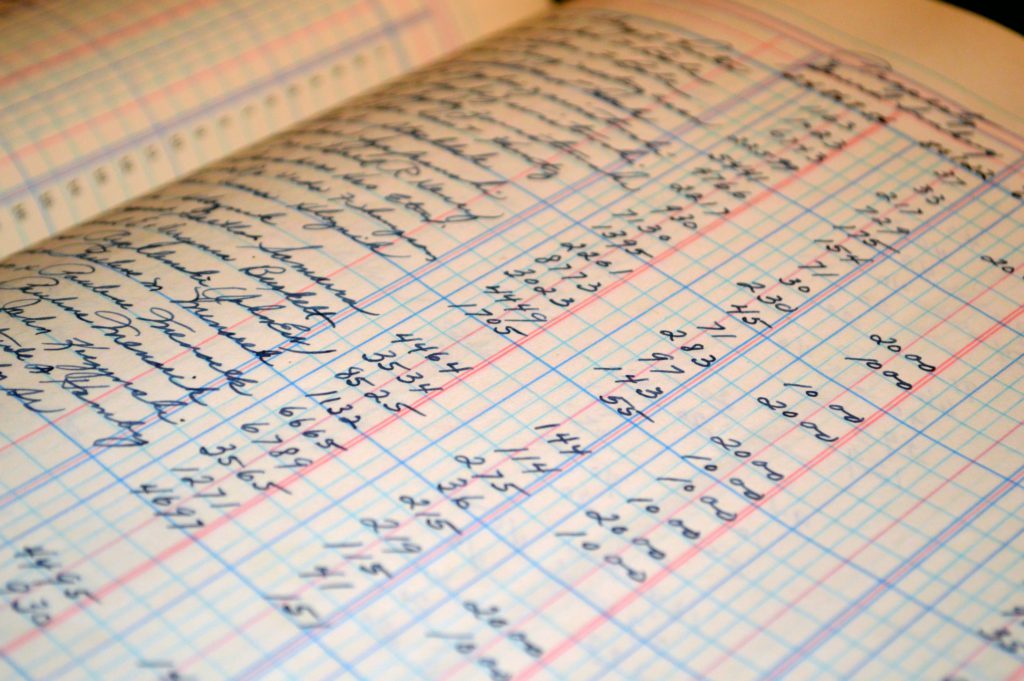

- Record on the left side of the ledger sheet

- Decrease in revenue

- Increase in expense accounts

Below are the rules for credits:

- Record on the right side of a ledger sheet

- Increase in revenue

- Decrease in expense accounts

Rules For The Accounts

Several accounts are always used in double-entry accounting. These include:

- Asset accounts

- Liability accounts

- Expense accounts

Importance of Double Entry Bookkeeping

There are many advantages of using a double-entry bookkeeping system:

- Double-entry bookkeeping gives you a fine financial records picture to see the growth level of your company.

- It helps track all the financial dealings of your business and check different parts of your business.

- A balance sheet using a double-entry bookkeeping method tells you if your accounting records are accurate or not. It is much safer than the single-entry bookkeeping method.

- A double-entry bookkeeping system gives you reports that give investors, banks, and other buyers a complete picture of your business.

Related Articles: